You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Illinois Sales Tax Rate-Is this right?

- Thread starter OhMari

- Start date

I'm going, sorry.

When we moved from PA to AL, we bought a house. When we closed on it, we both questioned the real estate taxes. We pay about a 1/4 of the taxes that we used to, on a larger house.

PREACH!

same thing with us moving california to washington. we have a comparable home but w/10 acres vs. a 1/4 acre lot (over sized for a subdivision there) and yet 11 years after moving we are still paying less than 70% of what we paid there in property taxes

granted, our sales tax rate is just shy of 9% (groceries/prescriptions are exempt) vs. our former at just about 7% but it in no way, shape or form would it ever in a single year cost us more in sales tax than we've saved in property taxes (and if we are going to purchase a big ticket item that we can transport home ourselves we just hop over to idaho and save 3%).

debknight

On the road to nowhere...

- Joined

- Oct 9, 2001

Sales tax 11.25% here

Which Chicago suburb is this? Or are you talking about the City proper?

https://www.illinoispolicy.org/illi...tax-burden-in-midwest-seventh-highest-in-u-s/

Illinois combined sales tax rate is the highest in the midwest and the 7th highest in the nation- higher than NY and California.

http://www.chicagotribune.com/class...408-property-taxes-primer-20180402-story.html

Our property tax rates are 2nd highest in the nation. Only New Jersey is higher.

There is a reason everyone wants to leave. We have 2 more years of High School and 3+ years until retirement. We are counting the days until we can get the heck out of this state!!! I am hoping to list my home the fall of my son's senior year. It may take a long while to sell because no one is buying here.

What part of Illinois? The real estate market is pretty hot by me.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

Those numbers may not be accurate for KS (which is where I live).https://www.illinoispolicy.org/illi...tax-burden-in-midwest-seventh-highest-in-u-s/

Illinois combined sales tax rate is the highest in the midwest and the 7th highest in the nation- higher than NY and California.

http://www.chicagotribune.com/class...408-property-taxes-primer-20180402-story.html

Our property tax rates are 2nd highest in the nation. Only New Jersey is higher.

There is a reason everyone wants to leave. We have 2 more years of High School and 3+ years until retirement. We are counting the days until we can get the heck out of this state!!! I am hoping to list my home the fall of my son's senior year. It may take a long while to sell because no one is buying here.

It says it's the 2nd highest in the midwest at 8.62% average but that news story is from Feb 2017 I agree on the ranking just not necessarily the average though I've not done the numbers on it. In that time period multiple cities have raised their sales tax as well as added special tax districts-heck there's a new one coming up right by my house starting in August with a 1.0% increase (the developer wanted 2.0% but that's pretty much unheard of around here usually it's 1.0% higher sales tax rate).

Dan Murphy

We are family.

- Joined

- Apr 20, 2000

Arlington HeightsWhich Chicago suburb is this? Or are you talking about the City proper?

Chicago may be higher.

Arlington Heights

Chicago may be higher.

Should only be 10% there, unless you're referencing something like alcohol tax or something.

https://www.avalara.com/taxrates/en/state-rates/illinois/cities/arlington-heights/

By the way, don't click that link. Disboards diverts it. Rather, copy and paste it if you want to check my reference.

Dan Murphy

We are family.

- Joined

- Apr 20, 2000

Food and beverage additional 1.25%. Guess I mostly look at those receipts, as a rough guide for tipping purposes. Those towns listed in that link are where I most frequent. 1-3% additional.

http://www.dailyherald.com/article/20160629/news/160628967/

http://www.dailyherald.com/article/20160629/news/160628967/

Food and beverage additional 1.25%. Guess I mostly look at those receipts, as a rough guide for tipping purposes. Those towns listed in that link are where I most frequent. 1-3% additional.

http://www.dailyherald.com/article/20160629/news/160628967/

Ha. As I read that article I thought "well I won't eat in Hanover Park, which is 1 mile from me. Instead I'll go to Streamwood. Oh wait, they're 2%. Schaumburg? 2%. Hoffman Estates? 2%" Consider yourself lucky up there in AH.

As I said in an earlier post, if you're locked in with a good job, the taxes don't hurt too bad. I only think about them when making a big purchase like a car or TV. If the money coming in is the same in Cook County or elsewhere, though, I fully understand why people would want to leave.

star72232

DIS Veteran

- Joined

- Jun 6, 2013

Our tax is 13%. It’s 78% provincial and 5% country wide. Some items are only charged one tax, some none, and some both.

I'm glad we don't pay 78% provincial tax!

I'm in Ontario. 13% total, of that 8% is provincial and 5% is federal. Sales taxes are not included in the price that is advertised, so be prepared to pay more than you were expecting if you are visiting. Some foods (grocery staples) aren't taxed (but prepared foods are, as are things like cookies, etc). Kids clothes and books only have the 5% federal tax charged.

It seems odd to me that individual cities/counties charge different taxes that other places within the same state!

I'm glad we don't pay 78% provincial tax!

I'm in Ontario. 13% total, of that 8% is provincial and 5% is federal. Sales taxes are not included in the price that is advertised, so be prepared to pay more than you were expecting if you are visiting. Some foods (grocery staples) aren't taxed (but prepared foods are, as are things like cookies, etc). Kids clothes and books only have the 5% federal tax charged.

It seems odd to me that individual cities/counties charge different taxes that other places within the same state!

It's a separation of power thing. The more you spread control around, the less corruption there should be. Many think it leads to cronyism, though. Sales tax rates are not built into anything except gas here, so there can be some sticker shock when buying.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

You'd have to look at what the sales tax is getting you.It seems odd to me that individual cities/counties charge different taxes that other places within the same state!

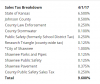

For instance in my city the sales tax comprises of this:

Here is the city where my mom lives which is right by me:

In addition to that you can have community improvement districts (CID) and transportation development districts (TDD). For community a lot of times it's the developer who is bringing in improvements to the buildings, types of places, etc. For transportation is about improving the infrastructure in a specic area a lot of times in my area at least it's newer development so it might be widening the road, installing roundabouts/lights,stop signs,turn lanes, creating new roads or entrances and exits out of a place, etc.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

I don't know that it has much to do with separation of power unless you're meaning that the state doesn't dictate all the rates for all the cities and counties within a state for all the components of a total tax rate.It's a separation of power thing. The more you spread control around, the less corruption there should be. Many think it leads to cronyism, though. Sales tax rates are not built into anything except gas here, so there can be some sticker shock when buying.

At least in my area different cities use their sales tax rates for different things within their city, sometimes they raise the mill levy for property taxes to do it and sometimes (it seems more often than not) they raise the sales tax rate. Then there are things like the county tax for county purposes and state tax for state purposes but the more individual variances are at the city level designed to support the specific city.

A smaller city doesn't have the same needs as a larger city. A city with less population doesn't have the same needs as a more heavily populated or at least more heavily travelled city, etc.

I don't know that it has much to do with separation of power unless you're meaning that the state doesn't dictate all the rates for all the cities and counties within a state for all the components of a total tax rate.

At least in my area different cities use their sales tax rates for different things within their city, sometimes they raise the mill levy for property taxes to do it and sometimes (it seems more often than not) they raise the sales tax rate. Then there are things like the county tax for county purposes and state tax for state purposes but the more individual variances are at the city level designed to support the specific city.

A smaller city doesn't have the same needs as a larger city. A city with less population doesn't have the same needs as a more heavily populated or at least more heavily travelled city, etc.

Different areas are made up of different people with dissimilar preferences. Towns are allowed to vote for tax increases to help attract top talent to teach their kids, or to keep that money in their pockets. They can elect state government that wants to lower taxes, or that wants to focus on fixing something like the roads. In principal, it is a good system. Of course there are those who figured out how to take advantage of and exploit every loophole possible within it, leading to messes like what we have in Illinois.

Mackenzie Click-Mickelson

Chugging along the path of life

- Joined

- Oct 23, 2015

I'm still not understanding what you're saying in relation to sales tax. Your previous statement was to the tune of it's the reason why different cities and counties within a state have different sales tax.Different areas are made up of different people with dissimilar preferences. Towns are allowed to vote for tax increases to help attract top talent to teach their kids, or to keep that money in their pockets. They can elect state government that wants to lower taxes, or that wants to focus on fixing something like the roads. In principal, it is a good system. Of course there are those who figured out how to take advantage of and exploit every loophole possible within it, leading to messes like what we have in Illinois.

As far as why IL is the way it is...it's a convoluted politically charged conversation that isn't really allowed to be discussed indepth on the DIS.

bcla

On our rugged Eastern foothills.....

- Joined

- Nov 28, 2012

Different areas are made up of different people with dissimilar preferences. Towns are allowed to vote for tax increases to help attract top talent to teach their kids, or to keep that money in their pockets. They can elect state government that wants to lower taxes, or that wants to focus on fixing something like the roads. In principal, it is a good system. Of course there are those who figured out how to take advantage of and exploit every loophole possible within it, leading to messes like what we have in Illinois.

At least around here it's the industrial towns with small populations that have built lots of shopping to bring in sales tax revenue.

Emeryville, California may be know for Pixar, but their biggest source of taxes come from sales tax receipts from the big shopping areas (Powell Street Plaza, Bay Street, East Bay Bridge, and Ikea). They have a population around 11,000, but they take in massive tax revenues.

There's a small incorporated town south of San Francisco called Colma. They're primarily known for being the place where cemeteries were built after San Francisco placed a moratorium on new ones. They have a live residential population of less than 2,000, but they have a large big box shopping center that brings in sales tax revenues.

Cannot_Wait_4Disney

The Colombo of Cippolini.

- Joined

- May 18, 2005

I was actually trying to add context that while Cook County residents pay sales tax on top of other state taxes, TN doesn't have that additional tax so Cook County residents are taxed at a far higher rate. I didn't realize that we had to have conversations in a bubble but I'll do that from now on.

No, you were actually just arguing and deflecting your condescension notwithstanding.

ndelaware

DIS Veteran

- Joined

- Oct 5, 2005

No sales tax in Delaware on most items. 4.25% on cars and 8% on hotels rooms.

Delaware has no sales tax, and does not allow cities or counties to levy any type of sales tax. Businesses are taxed on their gross receipts as an alternative to sales tax, but this tax cannot be passed on to consumers. A 3.75% "document fee" is collected on all automobile sales, and occupational license taxes of up to 1.92% are also collected on certain business activity.

While Delaware does not collect a sales tax, excise taxes are levied on the sale of certain products, including alcohol, cigarettes & tobacco, and gasoline. These excise taxes are passed on to the consumer in the goods' price

I'm still not understanding what you're saying in relation to sales tax. Your previous statement was to the tune of it's the reason why different cities and counties within a state have different sales tax.

As far as why IL is the way it is...it's a convoluted politically charged conversation that isn't really allowed to be discussed indepth on the DIS.

To put the sales tax piece into perspective, the simple answer is some places have higher sales tax because they can get away with it. The majority of Cook County lives in Chicago, about a hour in any direction from the borders of the largest county in the country. When I lived on the border of the county, I would drive across the street to go shopping. Few can do that. Within Cook County, Schaumburg can throw on 2% extra tax on restaurants because many people from out of town go there to shop and eat. I don't mind paying a little extra on that because my property taxes are a bit lower due to it. Elk Grove, next to Schaumburg, does not have quite the shopping and eating scene, so they set up Red Light cameras to make a few bucks from people who are in a hurry to get into and out of their shopping destinations. Schaumburg user to also have them, but businesses complained so they removed them. By making taxing structure up to each municipality, on top of what is mandated by the Federal, State, and County governments, places are in theory able to do what is best fo their citizens.

-

Photos of 'Together Forever - A Pixar Nighttime Spectacular' Fireworks

-

Better Together: A Pixar Pals Celebration Pixar Fest Parade 2024

-

A Closer Look at Pixar Fest Merch Coming to Disneyland

-

Cast Member Adds Photo Op to Wall at eet in Disney Springs

-

35th Anniversary of Disney's Hollywood Studios Brings Special Merch & Experience

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 3

- Views

- 32

- Replies

- 2

- Views

- 65

- Replies

- 0

- Views

- 58