You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wells Fargo savings/checking promos - any opinions?

- Thread starter mikehn

- Start date

gottalovepluto

DIS Veteran

- Joined

- Jul 14, 2014

Love WF checking bonuses! Whenever I see a bank bonus I like to go search the bank on Doctorofcredit.com to see if the bonus is a good one. They’ll usual have a write up on whatever the current bonus is and an opinion on if it’s with doing (like, is a historically good bonus for what the bank has offered?). Checking is good bonus, the highest one hasn’t been seen for a few years. Savings seems ok.

tvguy

Question anything the facts don't support.

- Joined

- Dec 15, 2003

According to my ATM log in screen, I have been a customer for 60 years, since I was 7. Too late for bonuses I guess! Actually, the Savings and Loan the account was opened at was sold to a bank, and that bank was sold to Wells Fargo. But Wells Fargo considers me as having been with them from the start.

Im not one to jump around, but $525 for a savings account and $300 for a checking account is pretty easy money. It only takes a few minutes for me to go online and re-route my direct deposits and bill pays from my old bank. Wells Fargo seems to fit my needs.

john7994

DIS Veteran

- Joined

- Mar 20, 2022

Bailey Building and Loan?According to my ATM log in screen, I have been a customer for 60 years, since I was 7. Too late for bonuses I guess! Actually, the Savings and Loan the account was opened at was sold to a bank, and that bank was sold to Wells Fargo. But Wells Fargo considers me as having been with them from the start.

I kid of course

- Joined

- May 27, 2011

I wouldn't bank with Wells Fargo due to their illegal dealings at the expense of customers. I believe they are still under sanctions with the US govt because of it.

QueenIsabella

DIS Veteran

- Joined

- Jan 17, 2016

On this thread:

https://www.disboards.com/threads/issue-with-financial-planner-looking-for-thoughts-input.3931330/

I talk about issues I had with my financial planner. Our regular bank is Wells Fargo. They promptly notified me that I was about to overdraft (both times) and gave me time to fix the problem. In addition, a few weeks ago, they sent me a fraud alert on my credit card and quickly cancelled the cards and sent me new ones. So, I can only say good things about their customer service.

Among our family, we have maybe a dozen different accounts there, never a problem. We all have the app to track stuff, and the kids do virtually all their banking on their phones. I don't think we got any sign-on bonuses, although I did get one for their active cash credit card. I say, find the best bonus you can work with, and go for it.

https://www.disboards.com/threads/issue-with-financial-planner-looking-for-thoughts-input.3931330/

I talk about issues I had with my financial planner. Our regular bank is Wells Fargo. They promptly notified me that I was about to overdraft (both times) and gave me time to fix the problem. In addition, a few weeks ago, they sent me a fraud alert on my credit card and quickly cancelled the cards and sent me new ones. So, I can only say good things about their customer service.

Among our family, we have maybe a dozen different accounts there, never a problem. We all have the app to track stuff, and the kids do virtually all their banking on their phones. I don't think we got any sign-on bonuses, although I did get one for their active cash credit card. I say, find the best bonus you can work with, and go for it.

tvguy

Question anything the facts don't support.

- Joined

- Dec 15, 2003

I am very happy with Wells Fargo. I did not expect to be happy when they bought my old bank in 1996 but they have really done well for me too. And my Financial Planner moved to their Brokerage side, so it was on stop shopping for the most part. He still uses the Wells Fargo Advisors system, but Wells Fargo......like a lot of businesses......last year started spinning off may employees to become independent contractors. Wells Fargo saves money by not having to pay benefits, but my advisor says it allows him to offer clients good products that Wells Fargo staff advisors are not allowed to use.I talk about issues I had with my financial planner. Our regular bank is Wells Fargo.

I wouldn't bank with Wells Fargo due to their illegal dealings at the expense of customers. I believe they are still under sanctions with the US govt because of it.

i'm of the same mindset-we had some dealings with them years back that caused us to leave them. this was before the feds came down on them.

i wonder if they are offering these promos b/c the feds just last month eased up on their oversite-

(from an article dated 2/15/24)

The Office of the Comptroller of the Currency, the regulator of big national banks like Wells, on Thursday terminated a consent order that had been in place since September 2016. The order required Wells to overhaul how it sold financial products to customers and provide additional consumer protections, as well as employee protections for whistleblowers.

That consent order was put into place after a series of newspaper and government investigations in 2016 found Wells to have a poisonous sales culture that pressured employees into selling multiple products to customers though such products were not needed. Employees — who worked at "stores" not bank branches — were forced to open millions of unauthorized accounts. Customers had their identities stolen and their credit scores impacted. Of the millions of customers effected, a disproportionate number were non English-speaking Americans.

georgina

DIS Veteran

- Joined

- Apr 21, 2003

I did the WF $525 savings account bonus last year. You had to open the account and within 30 days deposit $25,000 of new to WF money into the account. Could not transfer that much electronically (their rules), so I had to take in a paper check. Even though the money was taken from our Chase checking account the same day, they sent me letters telling me the large deposit was unusual activity and they suspected fraud, etc. So weird since it was their rules that I had to deposit a large sum right after opening the account. I closed it six months after I opened it and got the bonus. I was able to electronically transfer the money out in 2 transactions. Not a WF fan, but I will gladly take advantage of them.Wells Fargo has a couple promos going for new customers if you open a savings or checking account. I dont have any problems meeting the requirements to earn the promo bonuses. Just wondering if anyone has any opinions. Thanks

I bank with Wells Fargo and have been very pleased. Started using them a few years ago when relocating and the prior bank I was using didn't have locations where I was moving. That issue they had a few years ago where some employees were creating multiple accounts to meet some business goal doesn't make the entire organization bad. Some want to go around bashing a company for the improper things done by a few employees. I also don't believe in jumping around between banks chasing whatever promo they are offering. The few dollars you might claim isn't worth the hassle of constantly changing banks.

georgina

DIS Veteran

- Joined

- Apr 21, 2003

to each their own. When banks allow easy EFT transfers, it is not a hassle to move funds. We have gotten savings bonuses from Ally, WF, Citizens, Chase (savings and checking), and Marcus. It is NOT a few dollars. I never changed my main checking account, has been PNC for 30+ years, but DH did keep the Chase checking account which has come in handy several times, and I have had a Marcus online saving account for years, so putting in some extra money for a period of time for a bonus was a no-brainer.

gottalovepluto

DIS Veteran

- Joined

- Jul 14, 2014

That is my biggest problem. I was so happy putting my side-hustle biz account there I decided to keep it- but now I can't churn their biz accounts for new bonuses every couple years since I've already got one lol.I bank with Wells Fargo and have been very pleased....

ruadisneyfan2

DIS Veteran

- Joined

- May 20, 2006

If you look on www.doctorofcredit.com there are many, many banks that offer bonuses. I was very active in doing these before my dad started getting dementia and I had more free time to complete the requirements. For a few years, around 2018-2019, between dh and I we were making $5000/year in bank bonuses. Of course, it has to be declared as income so it would cause us to owe more on our tax return but who would turn down a $5k raise because they have to pay taxes on that income?i'm of the same mindset-we had some dealings with them years back that caused us to leave them. this was before the feds came down on them.

i wonder if they are offering these promos b/c the feds just last month eased up on their oversite-

(from an article dated 2/15/24)

The Office of the Comptroller of the Currency, the regulator of big national banks like Wells, on Thursday terminated a consent order that had been in place since September 2016. The order required Wells to overhaul how it sold financial products to customers and provide additional consumer protections, as well as employee protections for whistleblowers.

That consent order was put into place after a series of newspaper and government investigations in 2016 found Wells to have a poisonous sales culture that pressured employees into selling multiple products to customers though such products were not needed. Employees — who worked at "stores" not bank branches — were forced to open millions of unauthorized accounts. Customers had their identities stolen and their credit scores impacted. Of the millions of customers effected, a disproportionate number were non English-speaking Americans.

I miss doing them but I don't want to start something I can't finish and I don't want to end up paying fees because I didn't do what I could have done to avoid them.

gottalovepluto

DIS Veteran

- Joined

- Jul 14, 2014

These are fairly normal promos they’ve been offering for many yearsi wonder if they are offering these promos b/c the feds just last month eased up on their oversite-

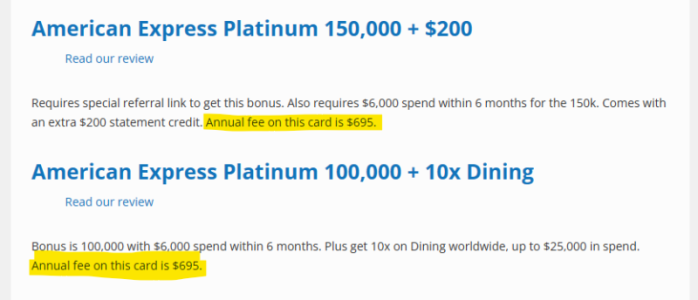

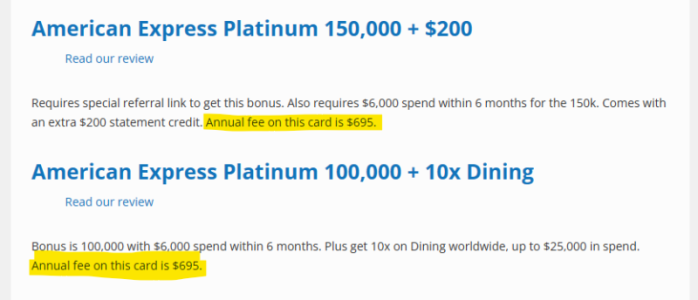

Also good to read the fine print on any supposed promos. I would consider the annual fee when deciding on any new credit card. Those supposed 'perks' are partly paid from the fees they collect, so it isn't the great bargain it would at first appear. Credit card companies are in the business of making a profit, not giving things away for free. Two examples I saw glancing at that website.

ruadisneyfan2

DIS Veteran

- Joined

- May 20, 2006

Sometimes fees are waived the first year. If they're not, then of course one should read the details of the perks and weigh whether or not it's worthwhile.

I have the Chase Sapphire Preferred card and get waaayyy more in rewards than the $89 AF. I always pay our card in full each month so we don't pay any interest but there are plenty of people who don't and Chase (& others) make a lot of money this way.

Chase also offers the Sapphire Reserve card, which has an AF of several hundred dollars. It offers more perks such as TSA PreCheck fees reimbursed, refunds for some travel expenses, but for us the value isn't there.

Always read the fine print for cc or bank bonuses to make sure you're able to satisfy the terms or it could end up costing you more than the bonus is worth.

I have the Chase Sapphire Preferred card and get waaayyy more in rewards than the $89 AF. I always pay our card in full each month so we don't pay any interest but there are plenty of people who don't and Chase (& others) make a lot of money this way.

Chase also offers the Sapphire Reserve card, which has an AF of several hundred dollars. It offers more perks such as TSA PreCheck fees reimbursed, refunds for some travel expenses, but for us the value isn't there.

Always read the fine print for cc or bank bonuses to make sure you're able to satisfy the terms or it could end up costing you more than the bonus is worth.

georgina

DIS Veteran

- Joined

- Apr 21, 2003

This thread is about bonuses for opening checking and savings accounts, not credit cards. You open a savings account, deposit X amount of dollars for X months, and get a cash bonus. Yes you need to read the fine print to see how to avoid any fees (usually keep a certain balance or have a direct deposit), but it is pretty easy to do that. Your post is the first to bring up credit cards. That's a completely different topic!Also good to read the fine print on any supposed promos. I would consider the annual fee when deciding on any new credit card. Those supposed 'perks' are partly paid from the fees they collect, so it isn't the great bargain it would at first appear. Credit card companies are in the business of making a profit, not giving things away for free. Two examples I saw glancing at that website.

View attachment 846804

-

Walt Disney World Bounce Back Offer Can Save You 25% to 35%!

-

Tokyo Disneyland to Replace Buzz Lightyear with Wreck-It Ralph Attraction

-

Does Anyone Have Disney Jollywood Nights 2024 Predictions?

-

Top 4 Reasons to Stay at Disney's Port Orleans Resort - French Quarter

-

A Brief History Of Disney: Disneyland's Matterhorn Bobsleds

GET A DISNEY VACATION QUOTE

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

Dreams Unlimited Travel is committed to providing you with the very best vacation planning experience possible. Our Vacation Planners are experts and will share their honest advice to help you have a magical vacation.

Let us help you with your next Disney Vacation!

New DISboards Threads

- Replies

- 1

- Views

- 83