GoingSince1990

DIS Veteran

- Joined

- Oct 31, 2018

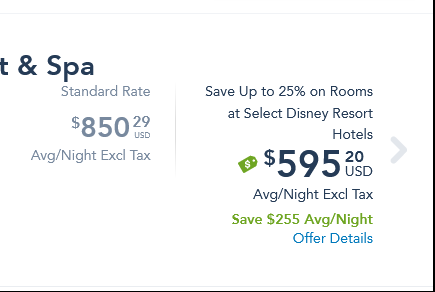

Nothing makes me feel as good about my DVC purchase as looking at the undiscounted cash rates for 2 and 3 bedroom villas.

I've said this before, but compare "current me" who owns timeshares to two different versions of "alternate universe me" who never bought them. Call them Me, Alternate Version 1, and Me, Alternate Version 2: AV1 and AV2There are extra trips, extra points, and the extra spending that is easy to do when you don't have a hotel bill. Bigger rooms.

I am guessing there are many like me where hotel room rack rate or even discounted rate was not an issue considered. I bought BWV shortly after it started in the 1990s and AKV when it was initially offered. Location was a key for BWV (OKW was the only other DVC resort at WDW at the time), and uniqueness of the resort was the key for AKV with the animals added, but the biggest factor was always that we usually wanted a 1BR or 2BR with a w/d and kitchen, which was not something available in the WDW hotel rooms.

Had to laugh at the "nookie tax"For us, our kids were young and we wanted regular and easy vacations - and staying in a multi room unit made that much more relaxing - the "nookie tax" - along with a washer and dryer that is invaluable when traveling with little ones. Its value - not savings, that makes DVC work for most people. Savings is the red herring.

^THISWe based our break even analysis on what we were actually paying for the moderate rooms we usually stayed in. That is the ONLY correct way to do it IMO - compare it against what you would have paid for real world trips, if DVC did not exist.

But, AV2 of me ended up traveling less, staying in smaller units, or in less luxurious destinations, and consequently spent a lot less on vacation travel than "current me". It's also more likely that "real me" would behave more like AV2 than like AV1. For example, I can guar-un-damn-tee you that no real version of me would ever pay cash for a week-long stay in a 3BR penthouse in Hilton's Lagoon Tower in Waikiki over the kids' summer break.

I’m tracking our trips since purchasing in May and am comparing our total out of pocket costs to pay cash vs. whatever the current discount for the same room and same dates would be.

I’m curious why most people always seem to say they compare rack rate…(including the numerous and unashamed DVC podcast that exist as nothing more than advertisements for resale)?

No one in their right mind pays rack rate so my assumption is it helps people mentally justify their purchase by “breaking even” quicker.

Even using a basic 20% discount vs rack rate seems more logical.

To each their own, but the podcasts and “trusted” agents seem to be completely misleading people into when you can break even. Granted buyer beware and do your research but I’m curious for thoughts from others.

Ah, so very true. Even if I investigated DVC a lot before buying, the decision at the end was an emotional purchase. It worked out great at the end.Because it's the easy "disney" math.

Why people buy DVC is often more complicated though.

No one in their right mind pays rack rate so my assumption is it helps people mentally justify their purchase by “breaking even” quicker.

Even using a basic 20% discount vs rack rate seems more logical.