CastAStone

Math and business nerd. Not an insider.

- Joined

- Jun 25, 2019

So there's a couple of reasons I don't love this math.I did the per point math for those resorts when I was deciding where to get my 100 points direct. At the 100-point mark, with current add-on incentives, they were, least-to-most expensive:

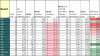

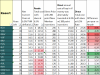

SSR, CCV, PVB, RIV, OKW, BLT, AKV

This was the (price per point/years left) + annual dues per point

- It ignores the difference between Direct and Resale. PVB/BLT are about $100 more Direct than resale. SSR/OKW/AKV are only about $65-$70 more Direct than resale. If one is buying some points resale and some direct I think the most important number becomes the upcharge they're paying for the direct points, not the price/year.

- It assumes that 2067 has the same value as 2021. There is a lot of risk in 2067. One may not be alive. One may develop issues with TWDC. The parks may become terrible. Florida's average high may be 116. I think it's a mistake to treat the inherent value of the out years as highly as the years in front of us

- Money in the future is less valuable than money today. People don't love this reality because it makes the math on all DVC purchases worse, but its a mathematical fact proven out over centuries, not an opinion.

In any case, I've posted this before, but here is my valuations of DVC direct purchases per point per year, and and the difference between direct and resale. Renting points through David's is currently $20/point, which is a good reference point if you assume you get zero value from the blue card (the resale prices used in the below are on the aggressive side, FWIW).

You like Advanced Math and I like Super Basic Math.

You like Advanced Math and I like Super Basic Math.